Définition : qu’est-ce qu’un produit dérivé ?

Un produit dérivé est un instrument financier qui prend la forme d’un contrat conclu entre deux parties. Ce contrat définit un échange financier futur qui dépend du prix d’un actif, appelé sous-jacent.

➡️ C’est d’ailleurs pour cela qu’on parle de produit dérivé : les flux financiers qui auront effectivement lieu dépendent – ou dérivent – d’un autre actif, généralement une action, un indice boursier, un taux d’intérêt ou encore une matière première.

🛢 Les premiers produits dérivés ont d’ailleurs été inventés pour permettre aux industriels de se couvrir contre la variation des prix des matières premières ; ce qui reste un cas d’usage aujourd’hui. Par exemple, une compagnie aérienne peut s’engager à acheter 1000 barils de pétrole à un producteur, dans 6 mois, à un prix fixé à l’avance. Ce faisant, la compagnie neutralise tout risque de hausse des cours du pétrole. Si le prix du baril dépasse le prix fixé à l’avance dans le contrat, alors on pourra dire a posteriori que ça a été une bonne affaire pour la compagnie aérienne.

Fonctionnement général des produits dérivés

Un produit dérivé fait intervenir deux personnes : l’acheteur et le vendeur. Le profit de l’acheteur et celui du vendeur dépend du prix d’un ou plusieurs titres financiers, appelés sous-jacents. Une échéance peut également être précisée, mais cela n’est pas obligatoire.

Le profit de l’acheteur peut alors être défini par une formule mathématique ou une condition logique. Imaginons, par exemple, un produit dérivé sur l’action LVMH :

- Si LVMH cote au-delà de 700 € avant le 1er janvier prochain, alors je vous donne 100 € ;

- Sinon, vous n’obtenez rien.

Ce produit dérivé basique, dont vous êtes l’acheteur et moi le vendeur, a pour sous-jacent l’action LVMH, pour échéance le 1er janvier prochain, et un résultat qui s’exprime bien par une condition logique.

Au moment où nous concluons cet accord mutuel, j’exigerai que vous me versiez une somme initiale, autrement le contrat est inégal. Cette somme s’appelle la prime.

Avant l’échéance du contrat vous pourriez aussi décider de vendre ce produit dérivé à quelqu’un d’autre. Si vous vendez ce produit à un prix supérieur à la prime versée initialement, vous réalisez une plus-value.

À quoi servent les produits dérivés ?

Les produits peuvent être utilisés dans plusieurs objectifs :

- Pour se couvrir contre un risque. C’était le cas dans l’exemple précédent de la compagnie aérienne, où le risque était une augmentation des prix du pétrole. Pour une société d’import export, le risque peut être la variation des cours des devises étrangères. Pour un gérant d’actifs, le risque peut être un krach boursier.

- Pour spéculer. L’un des avantages des produits dérivés par rapport à un investissement en direct – dans des titres vifs – est d’offrir un effet de levier. Autrement dit, cela permet de multiplier vos gains potentiels… mais aussi vos pertes. Un produit dérivé permet aussi de vendre à découvert très facilement pour parier sur la baisse d’une valeur. Dans cette optique, les produits dérivés sont, par exemple, très utilisés par les hedge funds.

- Pour des raisons pratiques. Il est parfois plus pratique ou plus rentable d’utiliser un produit dérivé plutôt que l’action sous-jacente. C’est par exemple le cas pour des raisons fiscales. Le dividende d’une action peut ainsi être plus fortement imposé dans un pays que dans un autre. Or, avec un produit dérivé vous pouvez éviter cette imposition. Dans d’autres cas, les produits dérivés permettent tout simplement d’investir plus simplement dans le sous-jacent. Prenons l’exemple d’un indice boursier. Pour répliquer sa performance, vous devez acquérir l’ensemble des actions de l’indice ; cela n’est pas forcément évident lorsque l’indice à plusieurs centaines de titres. Un produit dérivé dont le sous-jacent est l’indice boursier en question vous exposera à sa performance d’un seul coup.

Les principaux produits dérivés

Il existe de nombreux produits dérivés, des plus communs, qu’on qualifie de « vanilles » dans le jargon, aux plus complexes, qualifiés « d’exotiques ». Nous n’allons citer ici que les plus usuels et aussi ceux que vous êtes en mesure d’utiliser, en tant qu’investisseur particulier.

⤵️ On peut les regrouper en trois catégories principales.

1 – Les produits à transaction ferme

Les produits dérivés à transaction ferme engagent l’acheteur autant que le vendeur à la réalisation d’une transaction à une ou plusieurs dates préalablement définies. L’exemple le plus usuel est le contrat à terme.

Les contrats à terme

Un contrat à terme est un contrat dérivé qui oblige l’acheteur à acquérir le sous-jacent à un prix fixé à l’avance (prix forward) à une date donnée. Les contrats à terme sont très utilisés dans l’industrie pour acheter des matières premières avec un prix fixé à l’avance.

Les contrats à terme sont aussi utilisés à des fins spéculatives. En effet, si le prix forward se révèle inférieur au prix du sous-jacent effectivement constaté à l’échéance du contrat, l’acheteur peut instantanément revendre le sous-jacent au prix de marché et ainsi encaisser une plus-value.

Certains contrats à terme sont cotés en bourse, dans ce cas-là on parlera plutôt de futures.

Les swaps

Un swap est un produit dérivé qui définit un échange de flux financiers entre l’acheteur et le vendeur. Leur dénomination vient d’ailleurs de l’anglais to swap qui signifie « échanger » ou « troquer ».

Les premiers swaps étaient essentiellement utilisés pour échanger un taux d’intérêt variable en un taux fixe et ainsi neutraliser le risque de taux. Dans ce cas, l’une des partie paye chaque mois un montant variable (équivalant aux intérêts du taux variable) et reçoit un montant fixe.

Désormais les swaps sont monnaie courante entre les banques d’investissement et concernent toutes sortes d’actifs. Vous pourriez, par exemple, établir un swap entre la performance de Peugeot et celle de Renault si vous pensez que la première action va s’apprécier davantage que la seconde.

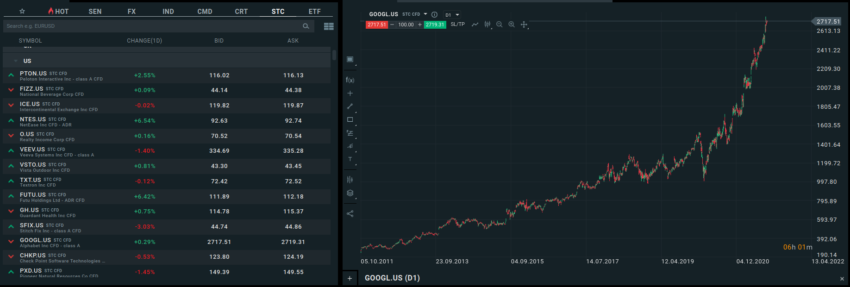

Les CFD

Les CFD, ou Contract For Difference, sont des produits dérivés très utilisés par les investisseurs particuliers car ils sont d’une apparente simplicité. Avec un CFD, vous touchez tout simplement la différence entre le prix d’achat du sous-jacent et le prix de revente, multiplié par un coefficient donné. Les CFD n’ont pas d’échéance et vous pouvez aussi bien les utiliser à l’achat qu’à la vente.

Les CFD sont donc utilisés pour investir sur les marchés financiers avec un effet de levier. Fort de leurs succès, vous pouvez désormais facilement trouver des CFD sur toutes sortes d’actifs sous-jacents : des actions aux matières premières, en passant par les indices boursiers, les ETF, où même les cryptomonnaies !

Contrairement à ce qu’on pourrait croire, les CFD ne sont pas cotés en bourse, ils s’échangent par l’intermédiaire d’un réseau de courtiers en bourse et de banques d’investissement, ce qui permet néanmoins de les trader instantanément.

➡️ On vous donne ici notre classement des meilleures plateformes de trading de CFD !

2 – Les produits dérivés optionnels

Avec tous les produits que nous avons listés jusqu’à présent, vous avez un engagement ferme. Par exemple, si vous achetez un CFD sur le CAC 40 et que l’indice baisse, vous devrez payer la différence. Remarquons aussi que ces produits n’entraînent pas de paiement initial, les flux financiers ont lieu in fine (ou aux différentes échéances pour les swaps).

Voyons ce qu’il en est des produits dérivés optionnels.

Les call options

Un call option (ou option d’achat) est un produit dérivé qui donne le droit – mais non l’obligation – d’acheter l’actif sous-jacent à prix et une date fixée d’avance.

Un call option a donc plusieurs paramètres :

- Le sous-jacent.

- La date d’exercice.

- Le strike : c’est le prix auquel vous avez le droit d’exercer l’option, c’est-à-dire le prix auquel vous avez le droit d’acheter le titre sous-jacent.

Par ailleurs, l’option est un droit qui a une valeur. Personne ne vous donnera d’option gratuite, vous devez donc l’acquérir. Le prix à payer pour acheter une option s’appelle la prime.

Vous gagnerez de l’argent avec une option à condition que le prix du sous-jacent à la date d’exercice soit supérieur au strike… et à la prime. En revanche, si jamais le prix du sous-jacent baisse très fortement, alors vous n’exercez pas l’option et vous ne perdez que la prime initialement payée.

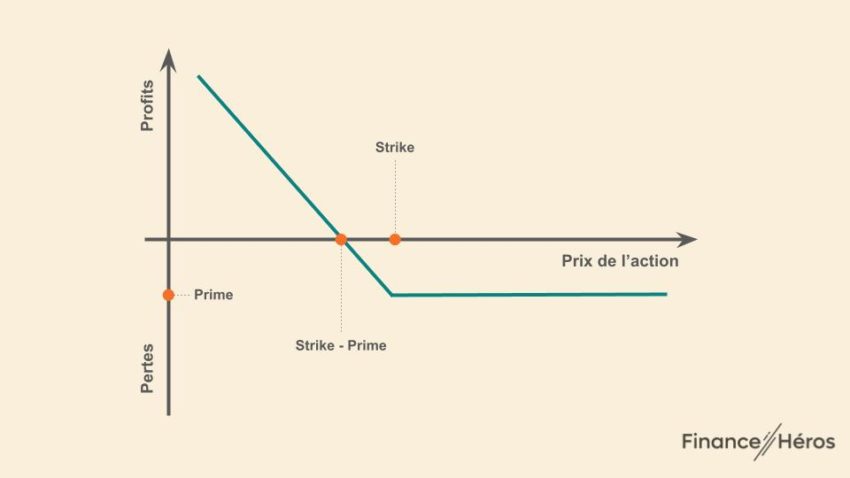

On peut représenter le profit d’une option sur un graphique, comme suit :

✅ Ainsi, avec une option d’achat, la perte maximale est limitée. C’est l’avantage des produits dérivés optionnels par rapport aux autres.

Les put options

Les put options (ou option de vente) fonctionnent sur le même principe. Seulement, cette fois-ci, vous achetez le droit de vendre un titre à un prix fixé à l’avance. Les puts servent donc à parier sur la baisse d’un titre.

Le profit est donc inversé par rapport aux calls :

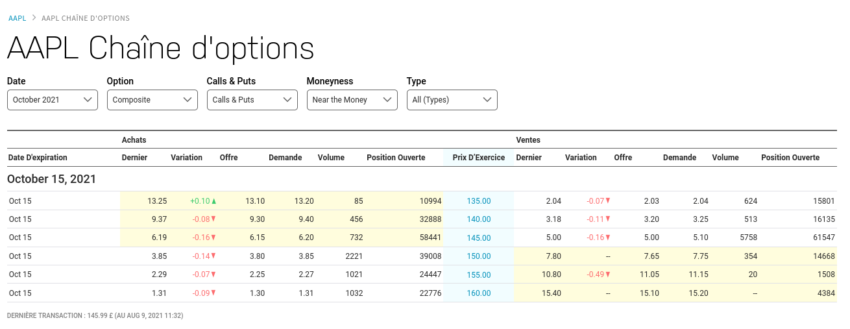

On comprend assez aisément que la valeur d’une option dépend de l’ensemble de ses paramètres, en particulier de la valeur du strike. Comme le montre l’exemple ci-dessous pour des options Apple, plus le strike sera bas et plus le prix des call options sera élevé. La configuration est bien sûre inversée avec les puts.

Les autres produits optionnels

Il existe de nombreuses déclinaisons de produis dérivés optionnels. On fait généralement la différence entre :

- les options dites « européennes », dont l’exercice est possible à échéance,

- et les options dites « américaines », qui peuvent être exercée à tout moment jusqu’à échéance.

Avec une combinaison d’options à des strikes identiques ou différents, vous pouvez aussi créer des stratégies optionnelles variées. Par exemple, en achetant un call et un put de même strike vous gagnez de l’argent dès lors que le prix du sous-jacent s’en éloigne suffisamment. C’est le type de combinaison qui est utilisée pour parier sur une augmentation de la volatilité.

Notons qu’il existe aussi les options binaires qui, comme leur nom l’indique, permettent de gagner une somme fixée à l’avance, selon que le sous-jacent est au-dessus ou en dessous du strike.

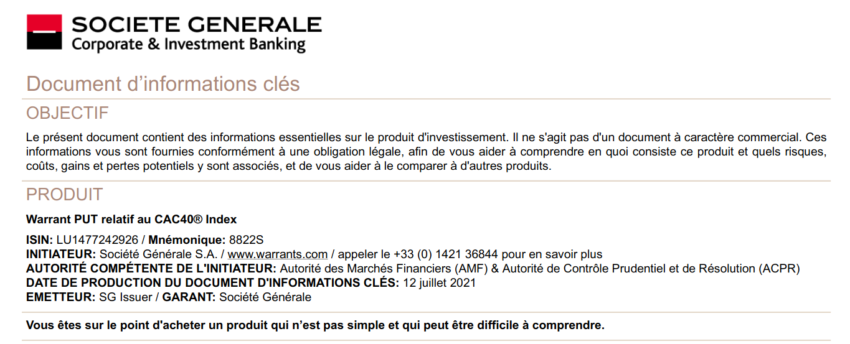

Les warrants et les turbos

Les warrants, aussi appelés certificats sont des options à destination des investisseurs particuliers. En effet, la plupart du temps vous aurez du mal à acheter vous-même des options. Le plus souvent, des transactions ont lieu over the counter, directement entre les établissements financiers et sans passer par la bourse. Certaines sont néanmoins cotées en bourse, on parle alors d’options listées, mais elle porte généralement sur plusieurs milliers, ce qui n’est pas à la portée de tous.

Pour donner accès aux mécanismes optionnels, certaines banques d’investissement commercialisent des warrants par l’intermédiaire de courtiers en bourse, mais leur fonctionnement est identique à celui d’une option d’achat ou de vente.

Les turbos sont d’autres produits dérivés commercialisés par les banques d’investissement à destination des particuliers. Ils se caractérisent par la présence d’une barrière désactivante : si le prix du sous-jacent passe en dessous de cette « barrière », a quelque moment que cela soit, alors vous perdez votre mise initiale. Sinon, vous gagnez la différence entre le prix de marché et le prix d’exercice.

Les autres produits dérivés

Il existe une autre catégorie de produits dérivés qu’on pourrait plutôt qualifier de produits titrisés. Il s’agit ici de regrouper plusieurs titres financiers en un seul produit via un mécanisme appelé titrisation.

L’exemple emblématique de ces produits titrisés est le CDO (Collateralized Debt Obligation). Un CDO est un regroupement de créances, comme des prêts immobiliers ou des prêts à la consommation, « pacakgés » pour en faire un produit négociable sur les marchés financiers.

En transférant le risque de crédit des banques aux marchés financiers, les CDO sont tristement connus pour avoir participé à la crise financière des subprimes.

Comment acheter un produit dérivé ?

Certains courtiers en bourse donnent accès à des produits dérivés en plus des habituelles actions, ETF et autres fonds d’investissement. Vous devez néanmoins distinguer deux types de courtiers :

- les courtiers classiques, qui commercialisent des warrants et des turbos et, dans certains cas, des futures et des options listées ;

- les spécialistes des CFD qui ne proposeront généralement que des CFD en plus des actions.

Les CFD sont les plus simples et les plus intuitifs. Ils présentent l’avantage d’une cotation en continu (y compris en dehors des heures de bourse) et les marchés couverts par les CFD sont de plus en plus larges.

Les plateformes de trading de CFD sont nombreuses : CMC Markets, XTB, eToro, …etc sont autant de brokers dont vous pouvez examiner les conditions pour trouver celui qui vous correspond.

➡️ Si cela vous interesse, consultez notre comparatif des meilleures plateformes de trading.

En revanche, si vous investissez principalement en actions ou en ETF et que vous souhaitez avoir la possibilité d’acheter un produit dérivé de temps en temps, nous vous conseillons plutôt DEGIRO ou Interactive Brokers qui ont tout deux l’avantage de proposer des warrants, des turbos, des futures, et même des options listées à frais réduits.

➡️ On vous en dit plus dans notre comparatif des meilleurs courtiers en bourse.

Les risques associés aux produits dérivés

🚨 Si vous utilisez des produits dérivés dans un objectif d’investissement ou de spéculation boursière, vous devez être conscients des risques qu’ils représentent : vous pouvez perdre la totalité des sommes engagées.

➡️ Avec l’effet de levier, les pertes peuvent rapidement s’accumuler si le sous-jacent évolue dans le mauvais sens ; jusqu’à tout perdre.

Par ailleurs, certains produits dérivés font peser un risque supplémentaire sur vos placements boursiers : l’appel de marge. En effet, lorsque vous achetez un CFD ou un future, votre courtier va mettre une partie de vos liquidités en « réserve » afin de s’assurer que vous puissiez couvrir vos pertes. Seulement, si le cours de l’actif baisse fortement, cette marge ne suffira pas et votre courtier exigera un apport en liquidités supplémentaire, c’est un appel de marge. Si vous n’êtes pas en mesure d’apporter les fonds supplémentaires, vos positions sont vendues et vous concrétisez les pertes. Les appels de marge sont particulièrement problématiques lorsque les marchés sont volatils. Sur le long terme, votre pari est peut-être gagnant, mais de fortes fluctuations peuvent rendre votre position intenable. Ayez-en conscience !

Tableau récapitulatif des principaux produits dérivés

| Produit dérivé | Type de produit | Mode d’échange | Disponible aux particuliers | Plateforme recommandée |

|---|---|---|---|---|

| Contrat Forward | Engagement ferme | OTC | – | |

| Future | Engagement ferme | Bourse |  | DEGIRO, Interactive Brokers |

| CFD | Engagement ferme | OTC via un réseau de courtier |  | XTB, eToro, Capital.com |

| Swap | Engagement ferme | OTC |  | – |

| Options vanilles | Optionnel | OTC et Bourse |  | DEGIRO, Interactive Brokers |

| Options exotiques | Optionnel | OTC |  | – |

| Warrants | Optionnel | OTC |  | DEGIRO, Interactive Brokers |

| Turbos | Optionnel | OTC |  | DEGIRO, Interactive Brokers |

OTC : overt the counter c’est à dire de gré à gré.

Laisser un commentaire