Depuis les accords de Bâle I en 1988, les banques doivent respecter un ratio de solvabilité minimum afin de garantir le remboursement de ses dettes et faire face aux divers risques liés à leur activité. Cette exigence de ratio minimal a vocation à renforcer la solidité des structures bancaires et cantonner le risque systémique.

Qu’est-ce que ce ratio de solvabilité et comment le calculer ? Réponse dans cet article, avec le détail des règles posées par Bâle II.

Qu’est-ce qu’un ratio de solvabilité ?

Le ratio de solvabilité représente la capacité d’une institution financière à rembourser ses dettes. Il s’exprime par un pourcentage, ou un rapport entre ses fonds propres et ses actifs risqués.

Les accords de Bâle ont pour objectif de recommander aux banques de structurer leur bilan d’une certaine façon.

Le premier ratio de solvabilité « Cooke »

Le premier ratio instauré en 1988 était le ratio Cooke. Il avait vocation à limiter le risque de crédit, c’est-à-dire le défaut de paiement des crédits par les emprunteurs. Le rapport entre les fonds propres réglementaires d’une banque et ses engagements (pondérés selon une méthode spécifique) devait être égal à 8% minimum.

Cependant, ce ratio a été jugé insuffisant pour assurer la solidité du système bancaire. Il a donc été remplacé par une autre méthode.

Le deuxième ratio de solvabilité « Mac Donough »

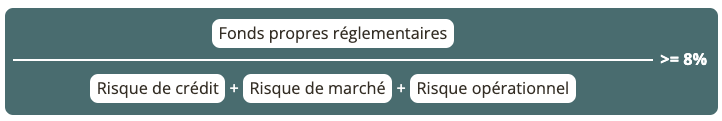

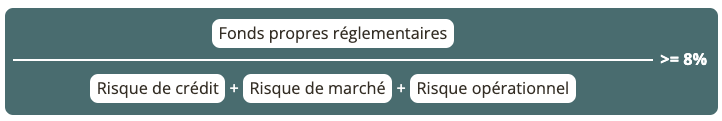

Le ratio McDonough a vu le jour avec les accords de Bâle II en 2004. La révision de la méthode a pour effet d’intégrer des risques autres que le seul risque de crédit. Ainsi, les risques de marché et risques opérationnels sont pris en compte. Cet article décrit en détail la méthode de calcul du ratio McDonough.

Notez que les accords de Bâle n’ont pas directement force de loi mais sont transcrits par les autorités de régulation dans les réglementations locales. En Europe, c’est la communauté européenne qui se charge de faire appliquer les recommandations du comité de Bâle, via la CAD (Capital Adequacy Directive).

Le ratio des accords de Bâle II, baptisé ratio Mc Donough ne change pas l’esprit de l’accord initial mais l’enrichit. Pour désigner ce ratio on parle indifféremment de ratio de solvabilité ou d’adéquation des fonds propres. Le processus de négociation, dénommé Bâle II (Bâle 2), a duré plusieurs années et a fait couler beaucoup d’encre dans la presse spécialisée.

À savoir : le ratio Mc Donoug a de nouveau été révisé par les accords de Bâle III, après la faillite de la banque Lehman Brothers et la crise financière de 2008 qui a révélé l’insuffisance des exigences de fonds propres. Les règles prudentielles ont donc été renforcées en 2010.

Qu’est-ce que le bilan d’une entreprise ?

Le bilan d’une entreprise se décompose schématiquement de la façon suivante :

- Au passif figurent les sources de financement :

- Capitaux

- Dettes à plus ou moins long terme

- A l’actif figure tout ce que l’entreprise a réalisé grâce aux financements apportés, tout ce qu’elle possède :

- Les immobilisations corporelles (immeubles) et incorporelles (participations dans d’autres sociétés)

- Les stocks

- Les créances

Le bilan est présenté de telle sorte que Total Actif = Total Passif.

Les capitaux propres

Les capitaux propres sont l’ensemble des ressources « courant le risque » de l’entreprise, c’est-à-dire celles qui ne seront en principe remboursées qu’avec la liquidation de l’entreprise (fonds propres), ou celles qui ne doivent être remboursées qu’à très longue échéance (quasi-fonds propres).

L’actif net

L’actif net est quant à lui égal à l’ensemble des avoirs de l’entreprise diminué de l’ensemble de ses engagements réels ou potentiels :

Actif\ net = Actif\ immobilisé + Actif\ circulant\ et\ financier - somme des dettes

La solvabilité d’une entreprise, quelle qu’elle soit, est sa capacité à rembourser l’intégralité de ses engagements en cas de liquidation totale. Elle dépend donc de la qualité de ses actifs, et plus particulièrement de la facilité avec laquelle ceux-ci peuvent être liquidés, et du montant de ses engagements (dettes).

En synthèse

L’ensemble de ces équations s’appliquent au bilan d’une entreprise :

- Actif = Passif

- Capitaux propres + Dettes = Actif immobilisé + Actif circulant et financier

- Capitaux propres = Actif net

En conclusion, la solvabilité, qui intuitivement correspond au rapport Dettes / Actif net, peut également se mesurer par le rapport Dettes / Capitaux propres.

Application au cas d’une banque

Pour une banque traditionnelle ou une banque en ligne, les dettes sont essentiellement constituées des dépôts à vue. Les actifs financiers sont constitués des crédits octroyés. C’est en effet la finalité d’une banque que de distribuer du crédit !

La solvabilité d’une banque est donc sa capacité à faire face aux demandes de retrait de ses déposants. Et cela fait partie de la responsabilité des autorités de tutelle de s’assurer que les banques sont bien aptes à faire face à leurs obligations. Il y va en effet de la stabilité de l’économie tout entière d’un pays.

Dans l’égalité vue plus haut, on voit que pour pouvoir distribuer davantage de crédit, la banque doit soit collecter davantage de dépôts, au risque de ne pas pouvoir rembourser ceux-ci, soit renforcer ses capitaux propres.

Or, une entreprise se trouve davantage en sécurité si une partie de son actif circulant n’est pas financée par des ressources qui viendront à échéance dans l’année. L’actif présente toujours un caractère aléatoire et donc risqué (en particulier quand il est constitué essentiellement de créances comme pour les banques !), alors que les dettes, elles, sont inéluctables ! C’est pourquoi il faut qu’une partie de l’actif soit financé non pas par des dettes mais par du capital.

D’autre part, si on impose à une banque d’augmenter ses fonds propres, elle a plus à perdre en cas de faillite et aura donc tendance à adopter des activités moins risquées.

Conclusions

Le niveau de fonds propres est garant de la solidité financière de l’entreprise. Les fonds propres sont donc garants de la solvabilité de la banque face aux pertes que les risques pris à l’actif sont susceptibles d’engendrer.

Pour toutes ces raisons, le ratio de solvabilité, dans le cas des banques, s’exprimait initialement par le rapport du montant des fonds propres au montant des crédits distribués, ceux-ci étant pondérés par leur caractère plus ou moins risqué.

Dans sa nouvelle version, le ratio prend en compte d’autres catégories de risque que le risque de crédit, à savoir le risque de marché et le risque opérationnel et s’exprime de la façon suivante :

Dans les paragraphes ci-dessous nous allons passer en revue les différents éléments constitutifs du ratio. Le résumé qui suit donnera un aperçu du degré de finesse et de complexité des dispositions de l’accord de Bâle et des directives d’adéquation des fonds propres.

Définition des fonds propres réglementaires

Le dispositif intègre dans les fonds propres les éléments du bilan suivants. Ne sont cités que les éléments les plus significatifs, pour une liste exhaustive se reporter aux documents cités en annexe.

Fonds propres de base

| Eléments à ajouter | Eléments à déduire |

|---|---|

| Capital social ou assimilé (actions, certificats d’investissement, actions à dividende prioritaire) | Actions propres détenues |

| Résultat non distribué de l’exercice et réserves consolidées. | Partie non libérée du capital |

Fonds propres complémentaires

Ceux-ci ne sont pris en compte que dans la limite de 100% des fonds propres de base. Au-delà, ils doivent être inclus dans les fonds propres surcomplémentaires.

- de premier niveau : titres hybrides présentant certaines conditions, durée indéterminée entre autres,

- de second niveau :

- Autres éléments de dette dont la durée initiale est supérieure à 5 ans

- Au cours des 5 dernières années de vie, une décote de 20% par année écoulée est appliquée au capital emprunté

Fonds propres surcomplémentaires

- Instruments de dette subordonnée (une dette est dite subordonnée lorsque son remboursement dépend du remboursement initial des autres créanciers) à terme d’une durée initiale de plus de deux ans qui ne comporte aucune condition préférentielle de remboursement.

- Fonds propres complémentaires de premier niveau plafonnés.

- Fonds propres complémentaires de deuxième niveau plafonnés à l’exclusion des éléments décotés.

Dans la directive européenne, les fonds propres de base doivent représenter au minimum 50% du total des fonds propres requis pour couvrir le risque de crédit de l’établissement, le reste ne pouvant être assuré que par des fonds propres complémentaires, et au minimum 2/7 des fonds propres requis pour couvrir les risques de marché, le reste pouvant être assuré par des fonds propres complémentaires et surcomplémentaires.

Mesure du risque de crédit

Le risque de crédit est le risque qu’un débiteur fasse défaut ou que sa situation économique se dégrade au point de dévaluer la créance que l’établissement détient sur lui. Pour mesurer le risque de crédit, on va donc pondérer le montant total de la créance, ce qu’on appelle « l’encours », par la qualité du débiteur.

Le comité de Bâle définit donc plusieurs catégories d’expositions au risque de crédit, avec pour chaque catégorie une pondération à appliquer à l’encours prêté. Cette pondération va de 0% pour les Etats souverains, ce qui revient à dire qu’on considère que les créances sur les Etats souverains sont sans risque, à 150% pour les contreparties les moins bien notées.

En effet, dans l’approche standard (cf. plus bas) les pondérations à appliquer dépendent des notes attribuées à la contrepartie par les agences de notation (Moody’s, Standard & Poors…).

| Catégorie de contrepartie | Notation | |||||

|---|---|---|---|---|---|---|

| AAA à AA- | A+ à A- | BBB+ à BBB- | BB+ à B- | moins de B- | Non noté | |

| États, organismes supra-nationaux | 0% | 20% | 50% | 100% | 150% | 100% |

| Banques | 20% | 50% | 100% | 100% | 150% | 100% |

| Sociétés | 20% | 50% | 100% | 100% | 150% | 100% |

| Détail : Immobilier | 40% | |||||

| Détail : Autres | 75% |

Mesure du risque de marché

Le risque de marché est le risque de perte ou de dévaluation sur les positions prises suite à des variations des prix (cours, taux) sur le marché. Ce risque s’applique aux instruments suivants : produits de taux (obligations, dérivés de taux), actions, change, matières premières.

Le risque sur produits de taux et actions se mesure sur la base du « portefeuille de trading », c’est-à-dire des positions détenues par la banque pour son propre compte dans un objectif de gain à court terme, par opposition aux activités « normales » de financement et d’investissement.

Par contre, le capital requis pour la couverture des positions en change et matières premières s’applique sur la totalité de ces positions.

Chaque catégorie d’instrument nécessite une méthode de calcul différente, qui consiste toujours à évaluer d’abord une position, puis à calculer le capital requis en appliquant une pondération de 0 à 8% sur cette position.

Risque de taux

Instruments de dette

| Risque spécifique | |

|---|---|

| Titres d’Etat | 0% |

| Secteur public | 0,25% à 1,60% suivant la durée résiduelle |

| Autres | 8% |

| Risque de marché général | |

|---|---|

| Par maturité | Des pondérations standard sont définies pour les différentes maturités des positions. |

| Par duration | L’établissement calcule individuellement les sensibilités de chacune de ses positions |

Dérivés de taux

| Calcul de la valeur de marché (mark to market) du sous-jacent et application de pondérations standard liées à la maturité des positions |

Risque sur actions et dérivés actions

| Risque spécifique | Risque global |

|---|---|

| 8% des positions individuelles | 8% de la position nette |

Le risque de change

La position nette dans chaque devise est convertie dans la devise de référence. L’exigence en capital est de 8% du total des positions.

Risque sur matières premières

15% de la position nette dans chaque produit

Traitement des options

Les banques qui se contentent d’acheter des options peuvent se cantonner à l’approche simplifiée.

Par contre, les banques qui émettent (vendent) des options doivent utiliser une méthode plus sophistiquée.

Mesure du risque opérationnel

Le risque opérationnel est le risque de perte liée à des processus opérationnels, des personnes ou des systèmes inadéquats ou défaillants ou à des événements externes.

Dans l’approche standard, l’activité des banques est répartie entre plusieurs domaines ou « lignes métiers » (business line). A chaque ligne métier les autorités de régulation attribueront un facteur de pondération sur le revenu brut « moyen » censé refléter le risque opérationnel objectif encouru par chaque activité.

| Ligne métier | Pondération |

|---|---|

| Financement d’entreprise | β1 = 18% |

| Activités de marché | β2 = 18% |

| Banque de détail | β3 = 12% |

| Banque commerciale | β4 = 15% |

| Paiements et réglements | β1 = 18% |

| Fonctions d’agent | β6 = 15% |

| Gestion d’actifs | β7 = 15% |

| Courtage de détail | β8 = 12% |

Calcul du ratio final Mc Donough

Pour préserver la cohérence du calcul, les montants de fonds propres requis au titre du risque de marché et du risque opérationnel doivent être multipliés par 12.5 (l’inverse de 8% !) avant des les incorporer au calcul final.

| Risque | Montants de fonds propres |

|---|---|

| Risque de crédit | = Actifs pondérés en fonction de leur risque |

| Risque de marché | = Capital requis pour la couverture du risque de marché x 12.5 |

| Risque opérationnel | = Capital requis pour la couverture du risque opérationnel x 12.5 |

Ratio (rappel) :

Approches multiples du calcul des risques

Pour chaque catégorie de risque (risque de crédit, risque de marché, risque opérationnel), les banques ont le choix de s’en tenir à l’approche standard ou d’utiliser des méthodes plus élaborées basées sur leurs propres données et procédures.

Concernant le risque de crédit, il existe 3 approches possibles :

- approche standard : a fiabilité des contreparties est mesurée par les notes allouées par les agences de notation.

- l’approche IRB (Internal Ratings Based) fondation : c’est le propre système interne de notation de la banque qui peut être utilisé.

- ou l’approche IRB avancée : les banques sont encouragées à avoir leur propre système interne de notation car l’exigence en fonds propres est diminuée en cas d’utilisation de celui-ci.

Pour le risque de marché l’utilisation d’une méthode interne est également possible.

Concernant le risque opérationnel, 3 méthodes sont utilisables :

- l’approche » indicateur de base « , fondée unique sur le Produit Net Bancaire de l’établissement,

- l’approche standard décrite plus haut et l’approche mesures avancées basée sur les données historiques de l’établissement.

Pour chaque catégorie de risque l’utilisation d’une méthode avancée est encouragée mais soumise à l’autorisation des autorités de régulation. Et surtout il n’est pas possible pour un établissement qui a choisi une méthode avancée de revenir en arrière à la méthode standard…

Les 3 piliers de l’accord de Bâle II

Au-delà de l’approche « mécanique » du calcul des fonds propres, le comité de Bâle a souhaité définir plus précisément les conditions de fonctionnement adéquates du marché bancaire. C’est pourquoi l’accord de Bâle II repose en fait sur 3 « piliers » :

Le processus de surveillance prudentielle renforce le pouvoir des autorités de régulation et leur donne latitude entre autres de majorer les exigences capital réglementaires en cas de nécessité.

La discipline de marché décrit l’ensemble des documents que les banques doivent rendre publics afin de se conformer à la réglementation. Ces documents concernent principalement le calcul des fonds propres et l’exposition aux risques de l’établissement. L’utilisation de méthodes avancées sera conditionnée par la publication de ces informations.

Cette présentation ne donne qu’un bref aperçu et a surtout pour but de donner une idée de l’esprit des accords de Bâle.

Bank of International Settlements

Site de l’ACPR

Laisser un commentaire